COP 29: Between Rhetoric and Reality

Where COPs go, controversy follows. This year, the predictable chorus told us that the sentiment of COP was invalidated by the energy portfolio of the host. Azerbaijan is considered a ‘petrostate’, a notion encouraged by their statement that oil and gas was a ‘gift from God’.

Yes, Azerbaijan’s economy while small, is predominantly reliant on fossil fuel exports. Spending time in the city you see how new everything is, it is their fossil fuels that have given them a 10x increase in their GDP in 20 years. From their perspective it really is a gift from God. Ultimately, it’s the total amount of emissions put into the atmosphere over time which matters; the UK’s carbon footprint is 15 x bigger than Azerbaijan’s, and the UK (now self-described ‘climate leader’) has made itself one of the most deindustrialised countries in the world and has managed to give itself some of the highest electricity prices on the planet. The search continues for a country that wishes to follow the UK’s ‘lead’.

Before we delve into how COP could affect our businesses, I’ll quickly share my impression of the conference.

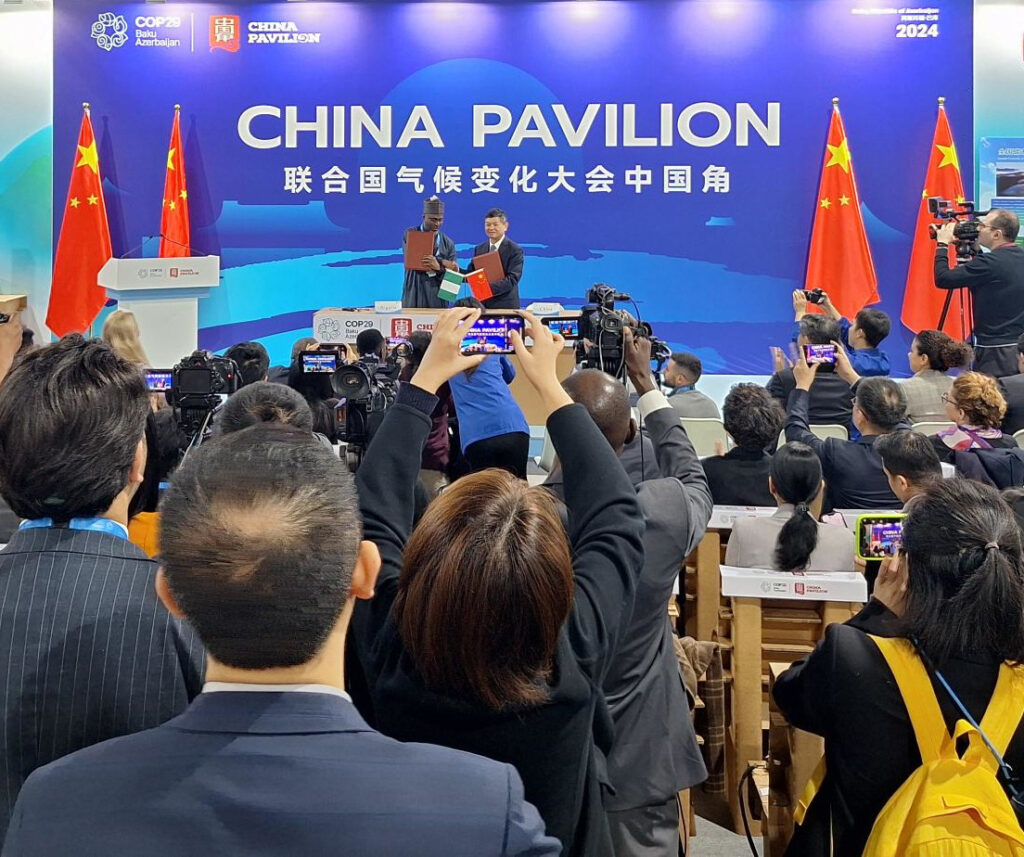

The Country Pavilion is where each country has its stall and serves as a symbol of their position on climate action. Saudi Arabia’s stall certainly looked the most impressive, and expensive. Uninterested American delegates sat in front of a rather barren stand, often scrolling on their mobile phones waiting for footfall to pick up. The UK and European stalls were mostly trying to impress you with their array of lofty targets and commitments. The EU also presented a feel-good, yet totally vacuous document on climate and social justice. One nation stood out. The Chinese. Their stall was one of the largest and the busiest, they were dishing out business cards, making project announcements, cutting deals with other states, and showcasing all of the new climate projects they were signing.

Make of that what you will, my impression is that is paints a rather accurate picture of how countries tend to see climate action, and the one most likely to seize its opportunities.

How will COP affect business?

The outcomes were modest, bar one.

Energy transition agreements were stalled by the usual players. Noises were made about the Loss and Adaptation fund, which has never really got off the ground after many years of discussion. There was however, a lot of discussion around climate finance and a lot of delegates in attendance who themselves are seeking to be party to investment in climate mitigation projects. This is a good sign as low carbon projects are expensive and require a lot more capital than countries can provide, so there won’t be much climate action without bringing in private capital. COP did see lots of small to medium sized climate finance agreements announced, but as always actions speak louder than words.

Businesses should take note of the newly announced Carbon Market Mechanism. Delegates finalised rules under Article 6.4 of the Paris Agreement, establishing a UN-regulated international carbon credit trading system. This mechanism is expected to unlock significant climate finance, primarily benefiting developing countries by facilitating investments in low-carbon technologies and emission reduction projects.

This is important because it is a step closer to a globally recognised Carbon Trading Framework. In recent years, carbon credits have taken a battering. The market shrunk by over half in 2023, much of this contraction can be attributed to an oversupply of low quality credits. While the carbon credit market reputation has been affected by some junk credits, carbon crediting and offsetting remains, if done properly, one of the most robust ways to divert capital to real climate action.

I think recent actions indicate a more pragmatic position being taken on the merits of carbon credits. Organisations like the UN and the SBTi, potentially, are starting to realise that emissions reductions are harder than they first seem, as demonstrated by the distinct lack of progress across almost every sector of the economy. A realistic decarbonisation plan naturally favours reductions wherever possible, but it also recognises that protecting and expanding carbon sinks is also essential, and the best strategy should contain both.

If carbon markets can achieve an upgrade in general quality standards and we have a quality system which comprises a meaningful UN stamp of approval, then both the quality of supply, and crucially, demand could increase. This would be a step forward in clarity and coherence for companies trying to make sense of their decarbonisation plans and implement meaningful 5-year strategies.

After watching multiple COPs roll by, you have to learn to read the signals in a lot of noise. While we didn’t see many big announcements we are starting to see more pragmatism and reality creeping into conservations. That’s something.

Chris Hocknell, Director

Chris brings over 17 years’ experience of supporting the built environment and corporate world with their sustainability goals. Specialising in sustainability strategy development, Chris works closely with clients to assess and understand their carbon and environmental footprint.