By the end of 2022, the total market issuance for all types of Green Bonds will surpass $1 trillion for the first time in a single year according to the Climate Bonds Initiative. This is up from $500 billion in 2021 making it one of the fastest-growing debt instruments in recent times.

Green Bonds are one of the most prominent innovations in sustainable finance; however, minimal oversight and lack of regulation have raised questions regarding the credibility of these instruments at delivering sustainable outcomes. Below, we examine two of the fastest-growing debt instruments, Green Bonds and Sustainability Linked Bonds (SLBs), and demonstrate the risk for greenwashing.

Green Bonds

Launched in 2008, Green Bonds are fixed-income instruments issued to fund specific environmental or sustainability projects.

Presently circa 10% of all bonds issued globally are green bonds underpinning the instruments’ role in bridging the estimated annual $2.5 trillion investment gap required to meet the targets set by the Paris Agreement and the UN Sustainable Development Goals.

Green Bonds have been issued by a variety of different organisations ranging from multilateral institutions to public and private companies with many successful outcomes. Some of those successes include solar voltaic systems financed by Green Bonds issued by the World Bank, which helped electrify rural households in Mexico and Peru. The corporate side has seen Green Bonds issued by the likes of Apple to support the execution of its 2030 carbon neutrality roadmap. Apple issued three Green Bonds since 2016 totalling $4.7 billion and recently stated that the investment allowed them to achieve 1,260,000 MWh in annual renewable energy generation, 357.7MW of newly installed renewable energy capacity, and 921,000 metric tons of avoided carbon emissions.

According to The International Capital Market Association (ICMA) which issue voluntary process guidelines, Green Bonds should align with four core components:

Bondholder Rights are Limited

Green Bonds are becoming exposed in the management of proceeds, where the company that has issued the bond is allocating and spending the money. The problem is that the Green Bond market has developed in such a way that none of the above guidelines present the bondholder (investor) with actionable rights. In some cases, the bond issuers have fine print warnings that stipulate they might not fulfill their environmental pledges removing all accountability. This opens the door to misuse by issuers and could result in Green Bond investments failing to be used for sustainability purposes.

A lack of regulation in the Green Bond market coupled with low accountability can lead to poor reporting practices on behalf of the bond issuer. This in turn can become an issue that damages the credibility of the investment, making it difficult for bondholders to confidently say that their investment is green.

Sustainability-Linked Bonds

Sustainability-linked bonds (SLBs) are a more recent iteration and in theory better designed because they are issued with specified sustainability performance targets (SPTs) and incorporate key performance indicators (KPIs).

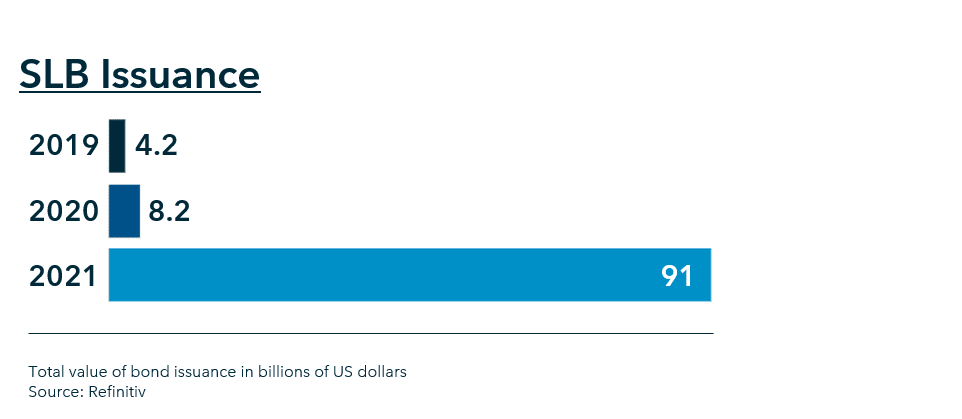

Issuance of SLBs exploded to $91 billion in 2021, from $8.2 billion in 2020 experiencing the biggest growth of all the green debt instruments.

The increased accountability comes from KPIs linked to the issuer’s previous sustainability reports that align with their sustainability strategy. An example of this would be a percentage reduction of Scope 1 and 2 Greenhouse Gas emissions by 2025.

An important distinction of the SLB is that if the sustainability targets are missed, the bond is subject to a “step-up” clause, meaning the bond interest rate increases. This in theory should increase the level of accountability and dissuade companies from improving at a slower rate or not improving at all.

Interest-rate Penalty is Negligible

Critics say the step-up interest rate penalties are considered weak, commonly adding only 0.125%-0.50% per annum in interest for the bond’s final years, this is effectively a risk-free rate. This coupled with the strong demand of SLBs in recent years means that some companies may end up achieving a lower cost of funding despite missing their targets.

Seek Transparency and Bold Targets

Transparency and ambitious measurable targets will be key elements to the success of sustainability-driven investments in the fixed income landscape. An understanding of what protocols and standards to look out for is a crucial part of the process to ensure the bonds are legitimate, credible, and transparent, we delve into this below.

Look Out for ICMA Bond Principles and Reputable SPO Verifiers

Here at Eight Versa, we recommend only investing in Green Bonds that are issued according to the Green Bond Principles (GBP) produced by the ICMA. For heightened transparency, a Green Bond Framework should be produced that explains the alignment of the Green Bond with the previously mentioned four core components of the GBP. Appointing an independent party, referred to as a Second Party Opinion (SPO) to conduct a pre-issuance review of the Green Bond and GBP framework is also recommended.

For SLBs it’s important that they are issued according to the Sustainability Linked Bond Principles (SLBP) and that the KPIs stem from existing sustainability performance targets. Targets should be:

-

Ambitious with a step-up interest rate penalty of at least 100 basis points (1%)

-

Represent a material improvement in underlying indicators

-

Set against a timeline with a clear target date

-

Linked to executive remuneration.

Look out for SPO verifiers that are reputable and present an analysis of the company’s historical data against past performance and versus sector peers. This will help to judge the ambition of the bond.

What's Next for Green Bonds and SLBs?

Green Bonds and SLBs issued in Europe will soon fall under the EU Green Bond Standard which will be built on market best practices such as those previously stated that we wholeheartedly welcome.

The future for Green Bonds and SLBs looks bright, but more accurate definitions are needed, and a more compliant market would be welcomed to sustain the growth and credibility of these financial instruments.

We don’t want environmentally- and socially-conscious investors being dissuaded from investing in a well-intentioned financial product that when executed correctly can drive capital to sustainable initiatives to help effectively tackle climate change.

Nuno Brito e Cunha

Nuno has experience in Sustainable Finance Disclosure frameworks and EU Taxonomy alignment, Investment portfolio management and analysis, PCAF Accounting, GHG Protocol standards, B-Corp Certification, TCFD Reporting, UN SDGs Framework application, Product Life Cycle Assessments (LCA), and Science-Based Targets (SBTi) reporting.

Get in touch with Nuno, and our team at Eight Versa and NCS, to find out more about green bonds and sustainable finance.